oregon tax payment extension

Most state extensions are due by April 18 2022. Oregon Drivers License Reinstatement Program.

Name and address change.

. State tax extensions happen automatically and you get the same 6-months you would get from your federal return to file your state taxes. Estimated Income Tax Payment Voucher Form OR-40-V Oregon Individual Income Tax Payment Voucher 150-101-172 Clear form Form OR-40-V Oregon Department of Revenue Oregon Individual Income Tax Payment Voucher Page 1 of 1 Use UPPERCASE letters. Has the Business Owner filed Kansas Individual Income Tax returns with the Department of Revenue for the following tax.

Even if you file an extension the tax liability must be paid in full by the original due date otherwise penalties and interest will be assessed. Print actual size 100. If you are an employee your employer withholds income taxes from each paycheck based on a completed W-4 Form.

The 2021 tax deadline to file City of Oregon returns is April 18 2022. Tax payments delivered US. Make a tax payment.

Penalties for not paying on time. But if you are self-employed or make money on your investments or rental property you may need to make estimated tax payments every quarter rather than wait until you file. Pay Delinquent Tax Debt Online.

Postmarked transmitted by private express carrier or paid online via the Douglas County website on or before a due date will be considered timely. This includes payment of your 2021 tax liability. But you will need to pay tax for the extra 25000 as a lump sum on April 15.

Set up a payment plan. 2020 Yes No 2019. Have you filed Kansas Individual Income Tax returns with the Department of Revenue for the following tax years.

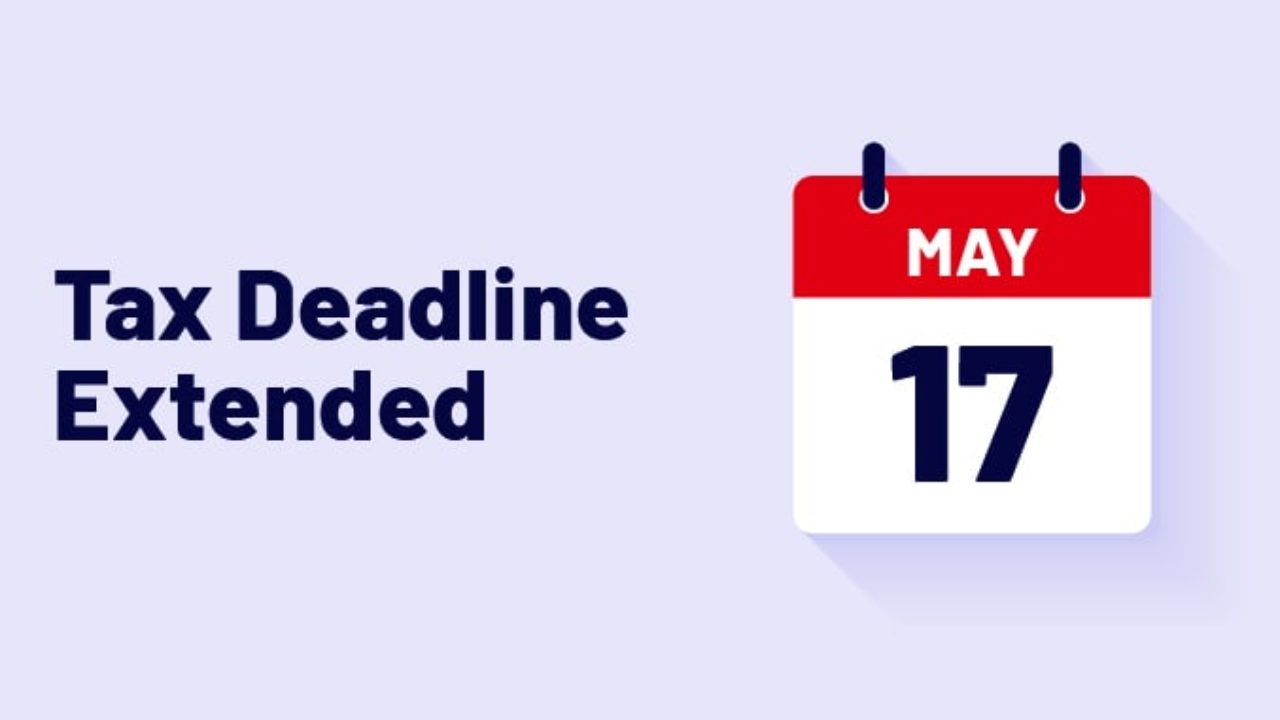

Oregon offering tax relief due to pandemic wil dfires Federal relief The American Rescue Plan Act of 2021 ARPA is a 19 trillion federal COVID-19 relief bill including more direct payments to taxpayers an expansion of jobless benefits funding for state and local governments and an expansion of vaccinations and virus-testing programs. Welcome to the Central Oregon Rental Owners Association. Use blue or black ink.

State income tax extensions are listed by each state below. If youre been missing payment deadlines its surprisingly complicated to figure out how much penalty you owe. Online Arts Tax payments will.

If you do owe taxes paying state taxes online or via check serves as a state. Senate Bill 278 and the CDC Moratorium Extension. So the deadline for every state once your extension is filed will be October 16 2023 to file.

To avoid loss of discount and interest charges tax payments must be post-marked by November 15 2021. You can make your quarterly tax payments based on the 75000 and you wont be penalized for it. Make a tax payment.

All Oregon residents and businesses are required to file annual City of Oregon income tax returns as well as any businesses with net profit or loss earned within the city. The Arts Tax is due at the same time as your Federal tax return generally April 15. If you do not owe taxes many states grant an automatic 6 month extension period.

Name and address change. Pay Delinquent Tax Debt Online. Filing_upsell_block Finding out how much penalty you owe.

Nonpayment means the nonpayment of a payment that is due to a landlord including a payment of rent late charges utility or service charges or any other charge or fee as described in the rental agreement or ORS 90140 90. Tax payment voucher Form OR-40-V. Valid e-mail address IMPORTANT PROPERTY TAX INFORMATION.

There is no extension to file or pay the Arts Tax. Payment are considered timely if the transmission time and date is prior to November 15 2021 at 1159 pm. For more information please visit our.

So tax notices for mismatches of incomeloss declared can also be expected If you miss the July 31 deadline submitting a late income tax return for the fiscal year 20212022 is December 31 2022. You can file and pay your Arts Tax or claim an exemption online by mail or in person. Usually thats enough to take care of your income tax obligations.

To receive a discount and avoid interest charges tax payments MUST be made timelyDue dates are November 15 2021 February 15 2022 and May 16 2022. Check the Extension Filed box when you file your personal income tax returns and attach a copy of your federal extension or verification of your Oregon extension payment with your return.

Latest Magento Extensions Magento Extensions Business Tools

Tax Extension Time Period H R Block

2020 Tax Deadline Extension What You Need To Know Taxact

Pin On Virginia Driving License Replacement

Irs No Penalty For Filing Taxes Late If You Re Getting A Refund

Here S Who Should Consider Filing A Tax Extension And How To Do It

How To Get Update Billing Information For Your Quickbooks Desktop Payroll Subscription Quickbooks Quickbooks Payroll Quickbooks Online

2020 Tax Deadline Extension What You Need To Know Taxact

Length 7 25 Height 10 75 Extension Depth 5 50 20300 Wh Rfr Access Lighting 20300 Wh Rfr P Access Lighting Contemporary Wall Sconces Wall Mounted Sconce

Recipe Tasting Food Test Hero Recipe Recipes

Boat Trailer Launching Extension Bar Boat Trailer Boat Trailer Parts Boat

West Seattle Route West Seattle Alki Beach Seattle Seattle Map