excise tax ma pay

Go to MassTaxConnect Make a payment and select your payment type. Notices Alerts Hide Notices Alerts Get important updates from DOR.

The tax is generated by the Registry of Motor Vehicles RMV who then sends out billing information to the city or towns assessor.

. Call 617 887-6367 or 800 392-6089. Services that incur excise taxes under the federal tax code include indoor tanning and online sports betting. MassTaxConnect Log in to file and pay taxes.

Pay Current Vehicle Excise Tax. All vehicles in the State of Massachusetts are subject to an annual motor vehicle excise tax. Pay warranted or marked motor vehicle or boat excise taxes below.

All Massachusetts residents who own and register a motor vehicle must annually pay a motor vehicle excise. See reviews photos directions phone numbers and more for Pay Excise Tax locations in Plymouth MA. Pay Personal Property Tax.

It is charged for a full calendar year and billed by the community where the vehicle is usually garaged. If your business offers. We send you a bill in the mail.

To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. The Internal Revenue Service defines an excise tax as one levied on specific goods or services According to IRSgov consumers pay federal excise taxes for goods such as fuel tires tobacco and heavy trucks. 9 am4 pm Monday through Friday.

The excise tax rate is 25 per 1000 of assessed value. Massachusetts Department of Revenue Corporate Excise Tax Massachusetts imposes a corporate excise tax on certain businesses. All information provided on an excise tax bill comes directly from the Registry of Motor Vehicles.

Under Massachusetts General Law MGL 60A all residents who own a motor vehicle must pay an annual excise tax. How to payPay your tax bill or notice by credit card. Pay DELINQUENT Springfield Taxes and Fees.

Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year. A A Motor Vehicle Excise All Massachusetts residents who own and register a motor vehicle must annually pay a motor vehicle excise. The City of Worcester accepts payments through our online payment partners.

The following steps for collection are set forth in MGL. Clicking the payment of choice will display the available options and any associated service fees. Bills are assessed on a calendar basis.

The tax is due on the 15th day of the third for S corporations or fourth for C corporations month after the end of the corporations taxable year calendar or fiscal. Paying Springfield Parking Tickets. If your vehicle is registered in Massachusetts but garaged outside of Massachusetts the Commissioner of Revenue will bill the excise.

The excise rate as set by statute is 25 per thousand dollars of. Kelley Ryan Associates Parking Tickets UniBank Government Services. The excise is levied by the city or town where the vehicle is principally garaged and the revenues become part of the.

If your vehicle isnt registered youll have to pay personal property taxes on it. Massachusetts State law allows motor vehicle excise tax exemptions for vehicles owned by certain disabled people and veterans former prisoners of war and their surviving spouses and charitable organizations. Pay Real Estate Taxes.

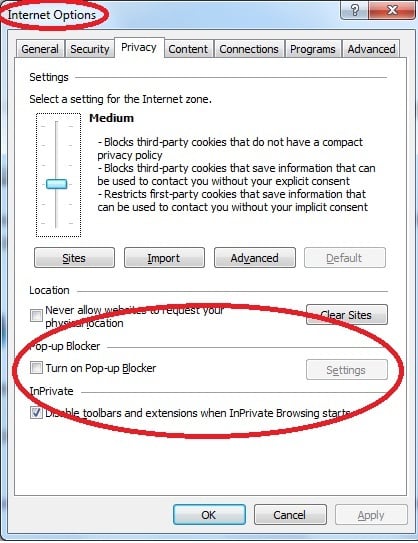

These charges will be reflected in your next real estate or watersewer bill. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Excise bills are prepared by the Registry of Motor Vehicles according to the information on the motor vehicle registration.

Generally all corporations operating in Massachusetts both foreign and domestic need to pay corporate excise tax. Tax Department Call DOR Contact Tax Department at 617 887-6367. Available payment options vary among services and our online payment partners.

Motor vehicle excise tax bills are due and payable within thirty days from the date of issue. As of January 2018 business return due dates have changed. Town of Seekonk PO.

Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660. Pay Your Water Bill. You pay an excise instead of a personal property tax.

All fees and penalties are tax laws under MGL. Excise Bills -Current Boat. Monies are both collected and deposited into its respective municipalitys general fund by the tax collectors office.

EXCISE ABATEMENTS Excise abatements are warranted when a vehicle is sold traded or donated within the year or has been registered in another state. Payments made online are subject to bank verification. Payments made after the due date are subject to interest and penalties.

Pay Delinquent Motor Vehicle Excise Taxes. General information required for an abatement is based on what happened to the car and what happened to the plate. Pay Springfield Police Department Ordinance Tickets.

Demand bills will be sent on all excise bills not paid within the thirty day period. Any unpaid bill accrues interest at a rate of 12 per annum from the 31st day to the date of payment. The excise rate is 25 per 1000 of your vehicles value.

See reviews photos directions phone numbers and more for Pay Excise Tax locations in Plymouth MA. Payable in full within thirty days of issue. Follow the instructions and provide the information asked.

Pay a Parking Ticket. Follow the instructions and enter the information asked. 19 2022 0534 pm Corporate excise can apply to both domestic and foreign corporations.

Including real estate property taxes automobile excise taxes trash fees and personal property taxes for other than the current fiscal year. An excise must be paid within 30 days of the issuance of the bill. The collector will send a demand which must be made more than one day after such excise becomes due.

Donations to Taxation Aid Fund. Contact Us Your one-stop connection to DOR. The excise is levied by the city or town where the vehicle is principally garaged and the revenues become part of the local community treasury.

You need to pay the bill within 30 days of the date we issued the bill. Pay Springfield Parking Tickets online Payments for parking tickets will no longer be. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089.

1942 Town Of Braintree Massachusetts Excise Tax 2 Trailer Auto Ephemera Braintree Braintree Massachusetts Trailer

Excise Revved For New Levy On Motorcycles

A Guide To Your Annual Motor Vehicle Excise Tax Wwlp

Search Results For Excise Tax City Of Revere Massachusetts

How To Pay Your Motor Vehicle Excise Tax Boston Gov

How To Pay Your Motor Vehicle Excise Tax Boston Gov

Online Payments Watertown Ma Official Website

Pay Your Bills Online Lowell Ma

Online Payment Center Clinton Ma

Excise Tax What It Is How It S Calculated

Pay Your Bills Online Winthrop Ma

Excise Tax Gloucester Ma Official Website

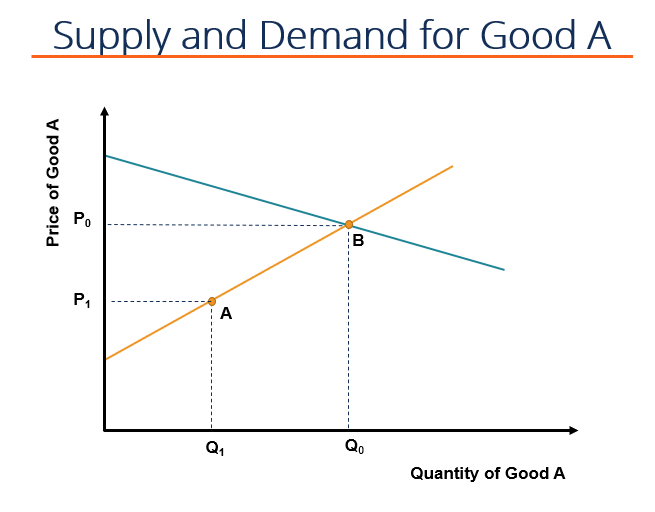

Excise Tax Overview And How It Affects The Price And Quantitiy Of Goods

Motor Vehicle Excise Information Methuen Ma

Gst India Tax Taxation Vat Excise Servicetax Indirecttax Economy Business Finance Law Corporate Ma Indirect Tax Goods And Service Tax Tax Credits